Ron Paul and Mark Spitznagel share a passion for non-interventionism, free markets, and Austrian economics. Congressman Paul served many years as a U.S. Representative from Texas, spanning 1976 to 2013, and was a Republican presidential candidate in 2008 and 2012. He has written extensively on liberty and politics, including The Revolution: A Manifesto and End the Fed. Spitznagel is the founder of Universa Investments, an investment advisor that specializes in tail-hedging, and is the author of The Dao of Capital, for which Paul wrote the Foreword. The two friends sat down recently to discuss topics ranging from the liberty movement and agricultural policy, to the consequences of Federal Reserve monetary policy. Here is a transcript of their conversation:

Mark Spitznagel: Ron, you have been the galvanizing force of a resurgent liberty movement in the United States. Yet, we find ourselves in this world where interventionism is on the rise, and much of America remains complacent about it. For instance, I think we would agree that today’s crony-capitalism and monetary-interventionism by central banks is at an unprecedented scale that will once again leave destruction in its wake. Why is America letting this happen, and moving away from its Jeffersonian ideals? Moreover, I have to ask you, has the liberty movement stalled, or even failed?

Ron Paul: Mark, on the surface and in Washington it may appear that interventionism is on the rise but in reality it’s on the defensive, more so than ever. Indeed there is a lot of complacency as that is frequently the rule for the majority of people regardless of the system. Where there is little complacency is with the intellectual leaders now leading the charge against the foreign and economic interventionists who have been in charge for decades and created the major crisis that we face today. It’s never easy politically to turn off bad policies and many times we have to wait until the policies self-destruct. The philosophy of non-intervention is growing significantly and that is crucial since ideas do have consequences. The obvious failure of the current system, and the current intellectual leaders of the younger generation who are more favorably inclined toward non-intervention, provide the encouragement we need to clean up the mess. During my presidential campaigns, I was always quite pleased when students held up signs saying: “You cured my apathy.’’

A question for you, Mark: I know you and a very few others like Jimmy Rogers know about authentic non-intervention in the economy, but what are Wall Street traders and investors like? Are they helpful in exposing crony-capitalism or are they part of the problem?

Mark: Unfortunately, Wall Street can’t help but respond to monetary intervention, like puppets to the Federal Reserve puppet master. Not only has the Fed turned just about every investor into a crazed gambler desperate for any yield above today’s artificially low interest rates, for professional investors the desperation is compounded by the career risk associated with underperforming in the very next period. If you’re fired for not having played the Fed’s game in the next round, who cares about what will happen in future rounds, and who cares about the long-run implications of this crony-capitalist game?

I see this temporal myopia at the very heart of Washington politics as well. If politicians don’t get reelected each period, then from a career standpoint any concern for the future was for naught. It ranges far and wide, from corporate managers to, even more significantly, farmers: Think of how debt and farm policy distortions induce wringing out everything that we can from each harvest, even at the expense of future harvests (such as with soil erosion).

Frédéric Bastiat said it best when he condemned the pursuit of a small present good that will be followed by a great evil to come, rather than a great good to come at the risk of a present small evil. The latter is extraordinarily difficult today. To me, your ability to focus away from the present and truly see the great good or evil to come was really so astonishing about your political career. What was your secret, Ron, and what kept you from losing sight of that?

Ron: The simple answer (and there’s a more detailed one) about my not “losing sight” is that I detest the current political process. Originally, I never expected to be elected and had one goal in mind: promote the Cause of Liberty. I firmly believed our country was headed in the wrong direction. I was confident that the Freedom Philosophy and the non-aggression principle offered the solutions to our problems. I had no interest in being molded or manipulated by those who held different views. Your views on political myopia are correct. This myopia, fueled by self-serving politicians and justified by economic mysticism, is at the heart of the problem. This myopia dictates that politicians, the day after they’re elected, start concentrating on the next election. The lobbyists love the system. They receive high rewards for getting benefits that frequently benefit a Member’s district. The lobbyists convince the voters that the system can be used for their benefit and the Member gets the credit. Good economic policy, moral principle, the Constitution, or challenging one’s party’s leadership rarely enters into the equation. At times I think the myopia approaches blindness.

Your point about how the government farm program greatly distorts the market is a perfect example of how long bad policies can last when some people immediately benefit at the often gradual expense of others. It happens with all government programs. Dairy farmers and dairies, in protecting their interests, have made it difficult, if not impossible, to drink raw milk—hardly a policy that a free society would endorse.

Mark: Oh yes, a subject near and dear to my heart! There’s a parallel between the case where benefits from policies are concentrated in the few and the costs dispersed among the many, and the case where benefits are concentrated early on while the costs are dispersed over time. In both cases, for many people it’s not an obvious fight worth fighting. But of course it is worth fighting. When the State gives special privileges to certain crops, for instance, the result is an artificial, disease- and pest-prone monoculture and a distorted ecosystem and food system around those crops. CAFOs (Concentrated Animal Feeding Operations), Corn syrup and the corn-fed-everything industries are products of government favoritism. More long-term, natural, and sustainable agricultural systems like organic or pasture-based are made to look impractical. It’s crazy how much bureaucrats determine what we grow and what we eat. Sustainable farmers should all be libertarians. The problem is that many “hippie” types coming from the Left see big agricultural companies implementing these harmful policies, and they understandably conclude, “That’s pure capitalism at work, that’s how the profit motive leads to disaster when it comes to food.” But no, that’s cronyism at work, that’s how government intervention leads to disaster. The very same thing happens with financial crises, of course—capitalism is always wrongly accused. We blame the system when we interfere with its natural homeostatic functioning.

Ron: Sustainable farming and libertarianism are a natural mix. I know that you yourself, in addition to being a hedge fund manager, are a pasture-based dairy goat farmer and artisanal cheese maker. Sustainable farming recognizes the perils of tinkering with the complex interactions of natural systems. And it rejects the notion of dependency on the government and emphasizes the principle of self-reliance. Of course, if this principle were to be followed in all areas of the economy we wouldn’t have to worry about prosperity or a shrinking middle class.

Mark: Do you think your background as a physician has influenced your acceptance of the idea of having reverence for a system’s natural resiliency, and not messing with that through tinkering?

Ron: There is no doubt that it did. I kept a copy of the Hippocratic Oath hanging on the wall at my medical practice of about 35 years. We know that today the government has little reverence for the economy’s natural resiliency, what Adam Smith referred to as the “invisible hand” of the market. Interestingly, in modern times the Hippocratic Oath has been changed to be more in tune with today’s legal system. The Oath now shows less reverence for life than it did originally. Maybe it’s a sign of the times. Once we restore the principles of a free, self-adjusting market, we’ll have to check and see if the Hippocratic Oath has been restored to its original form.

Speaking of doing no harm, I followed the story last June when you were blocked from trying to help a struggling, blighted neighborhood in Detroit by bringing in a herd of goats from your farm in Michigan, Idyll Farms. The goats would have cleared the neglected overgrowth, and the project was providing jobs and education to the community. But the Detroit City Hall chose to enforce an ordinance banning all livestock and immediately kicked your goats right out.

Mark: I’m a big believer in urban farming, especially for large open and economically-challenged areas like parts of Detroit. Call it a return to Jefferson’s yeoman farmer. One of the previously unemployed people I hired there told me he wanted to use his earnings from the summer to purchase a house. It was a win-win. By the way, we didn’t ask the city for permission to bring in the goats—and the local community encouraged us not to ask—because we knew what their answer would be. Hopefully we provided some momentum to change this bad ordinance.

Ron: What is your opinion of political action versus the importance of education?

Mark: They go together. How could our utterly failed public education system not have something to do with today’s complacency? Of course our system requires a thinking electorate, one that can see through the central planners’ economic mysticism you mentioned. As you know, Ludwig von Mises argued that all governments—even dictatorships—ultimately rest on public opinion. We can complain about the politicians and central bankers, but ultimately the only reason they can get away with these outrageous and wealth-destroying policies like corporate bailouts and asset inflation is that the public assumes they do something good. With our current state of economic ignorance and political apathy among the general public, we’re left with the lowest common denominator of plundering—not only of ourselves, but especially of those who are most powerless: future generations who, sadly, cannot yet vote. When you think about it, this is a huge burden on an electorate. Would you agree?

Ron: Definitely. It’s a safe bet that the quality of education in this country is inversely proportional to the increase in the Federal government’s involvement in it. Government schools have a predictable agenda: justifying the government and its programs. I was warned never to try to educate in a campaign yet that was always my goal. The understanding that public opinion is crucial to all political change recognizes that the intellectual leaders are key to a country’s future, both good and bad. But for the most part politicians aren’t interested in changing people’s minds. Their concern is to put their finger up to the wind to see which way it’s blowing and accommodate. I have always had an interest in working to change public opinion regarding the proper role for government in a free society, such as my efforts with my own FREE Foundation for 38 years and currently with the Ron Paul Curriculum for K-12.

Mark, when did you first get interested in Austrian Economics? Was it before you became a professional investor? How long did you contemplate writing your book The Dao of Capital? Do you issue any guarantees with its purchase?

Mark: Ha! Yes, the one guarantee is that you will incur much psychological trauma by practicing what I preach. Seriously, my book is about the thinking behind my way of investing, what I call “roundabout” investing (after the Austrian economics concept of roundaboutness)—so I’ve basically been contemplating it my entire adult life. But it took me about a year or so to actually write down. Roundabout investing is all about delaying gratification and taking small setbacks now for enormous positional advantage later. I regularly fall behind other asset classes during monetary expansions in order to maintain a position that eventually soundly passes them all by when the stock market crashes. The key is that the strategy (which I run in my hedge funds) pairs with a stock portfolio to robustly protect it against large losses—a “tail hedge.” The whole necessity of this protection specifically follows the bubble-blowing distortions of the Fed’s monetary policy. Austrian economics has always been central to my awareness of this. I happened upon the Austrians in college from Henry Hazlitt’s magisterial Economics in One Lesson which then turned me on to Bastiat and Mises—and my career would have been entirely different without them.

Mises will ultimately be right yet again about the inevitable final collapse of the current asset boom brought about by credit expansion. The term “black swan” (the surprising, unforeseen event) used for bursting financial bubbles has been and will remain a misnomer—we can and, indeed, should expect such tumults to occur at some point as a consequence of massive central bank intervention and economic distortion. Given the unprecedented scale of the Fed’s market manipulation this time around, how do you think this next one will play out, and will the Fed stop at anything to continue to delay the inevitable? Might they ever be politically restrained?

Ron: I agree with you that these “black swan” events should be anticipated, though timing is a different matter. The fact that you say you’re willing to “fall behind” other asset classes, it seems to me, means you have to practice patience, accept some losses, and be prepared. Since these are not usual human characteristics, do you think this gives us some insight into why those who understand Austrian economics are not necessarily good at market investing?

When Mises got married, he told his wife Margit that she would hear him talk a lot about money but they would never have a lot. I once asked Hans Sennholz, one of the few who got a PhD under Mises, whether Mises dealt with investments. His answer was that he did not. Sennholz believed that if the theories were correct one should participate and prove it. I know in the ‘70s Sennholz highly favored real estate investments. I pressed him a little on Mises’s apparent disinterest in personal investments and his response was that Mises’s responsibility was “to write and explain economics for the ages,” and leave it for another generation, the Mark Spitznagels, to prove the theories correct. I have tried to follow Mises’s admonition that it is our responsibility to make the economic theories “palatable” to the general public through persuasion.

As to the unwinding of this mess, I’m convinced that when the current expansion ends it will be abrupt, gigantic, and worldwide. The 43-year expansion of Fed credit and debt, delivered to us by a fiat dollar standard, and held together artificially by an undeserved trust will end badly. Though I’m optimistic on the long run because of the ideological groundwork being laid, I anticipate both serious economic and political crises. No one should expect Congress to cut spending or the deficits. Unfortunately, the welfare/warfare state is alive and well. They will continue to write regulations that are supposed to correct the previous regulatory mistakes and all the malinvestment generated by the Fed’s easy money policy. I can’t conceive of [Fed Chair Janet] Yellen ever persistently lightening up on the monetary pedal, despite her tapering to date. It is my belief that a dollar crisis will result from a major loss of confidence in it as a reserve currency.

What do you think the odds are for a “soft landing” for the economy? Am I overstating the seriousness of the problems we face?

Mark: I don’t think you are, Ron. I cannot see how a soft landing would be possible here. Net corporate debt is at all-time highs (so don’t let anyone tell you that corporate balance sheets are strong), interest rates are essentially pinned at zero, and the Fed’s balance sheet has exploded. Based on the Q-ratio—the most robust and predictive valuation measure there is—the stock market is more overvalued today than it was at every major top over the past century, save 2000. How could this get corrected in an orderly way?

As for your comments about Austrian economics, yes, it’s one thing to get it, quite another thing to practice it. Patience is everything. Everything. Unfortunately, human beings are wired to do the opposite of what we really need to do. In some ways I think of my investing just as you describe: a test to prove the Austrian theories correct. Of course this notion of “proof” is something that no deductive Austrian would accept. But I look at it from an entirely practical, rubber-meets-the-road vantage point.

Ron: What kind of preparations should average folks be taking? Should they own gold? Maybe some farmland?

Mark: Today’s environment is a quagmire for retail mom and pop investors out there. This is part of what is so insidious about the Fed’s trap. I believe—and history is entirely on my side—that retaining “dry powder” (capital to be invested later) and thus playing the roundabout will be the victorious strategy here. One way or another, we need to position ourselves for much greater opportunities to come. Gold has proven a sound store of value over the long term—with a good degree of trading noise thrown in just to make it difficult. Most stocks, credit, or long duration treasuries are clearly not a terrific idea when these markets are pricing in today’s very artificial, unsustainable economy. Productive, real assets that make things that people need and are reasonably priced regardless of interest rates, inflation, and the state of the economy are, to me, the best store of value these days. So farmland would be a terrific example, at least where prices haven’t already spiked. The economics, demographics, and ecological implications of agriculture will be profound.

I see you haven’t lost a step now that you are a non-Congressman, Ron. I have one final pressing question for you: Is your political career really over? Will you be personally involved in a political race in 2016? You will be sorely needed in order to direct the conversation on both sides. How can the presumed free market Republican Party nominate another candidate who favors bailouts and market manipulation? More than anything else, Americans need to be provided a clear choice between intervention and non-intervention.

Ron: Thank you for that word of confidence. But for me it looks rather clear that electoral politics is not on my agenda. There are no plans for my personal involvement in a political race in 2016. My continual campaign for liberty, nevertheless, will remain active. The exact format will be determined by the market. The financial support for the different activities I’m involved in will indicate which vehicle I should use to continue the “R3VOLUTION.” For me this campaign has been going on since 1973.

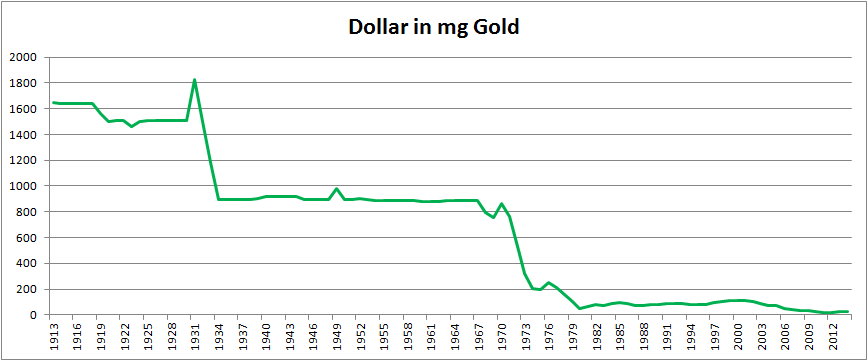

Five months after your birth, Mark, on August 15, 1971, Nixon announced that the gold standard was dead. That event motivated me to start speaking out about the serious problems I anticipated would result. Hazlitt, whose book you mentioned earlier as your first exposure to Austrian economics, predicted this would happen from the time the Bretton Woods Agreement was signed in 1945. This event convinced me that Austrian economists were right and motivated me to get involved. My first race for Congress was in 1974.

My political success was modest and surprising. The reception by the current Millennials was well beyond my expectations. I especially enjoy reaching out to the young people on college campuses and see only the positive signs of their interest in the liberty movement. That is the campaign I can’t imagine abandoning. As you have been motivated to “prove” the validity of Austrian economics with your financial success, I, in a somewhat similar way, have used politics for promoting the same ideological principle through political action.

Your challenge that Americans must choose between intervention and non-intervention isprecisely the issue. When pressed for a political label to describe myself, my favorite is “non-interventionist.” This must be in all areas: social, economic, and in foreign affairs. All intervention condones the initiation of force; non-intervention requires voluntarism and persuasion. The latter is the only road to peace and prosperity.